Insights

Opportunities presented by emerging technologies in capital markets

The dynamic landscape of global finance is witnessing a transformative era marked by the integration of emerging technologies like digital assets, blockchain, generative artificial intelligence (AI) and quantum technologies.

June 2024

Aman Thind

Global Chief Architect

In our previous editions of the Digest, we’ve explored how the recent development of generative AI could potentially interact with blockchain and tokenization to augment the growth of digital assets. However, as respondents to our third annual Digital Assets Study indicate, the integration of emerging technologies to improve processes across operations is already underway.

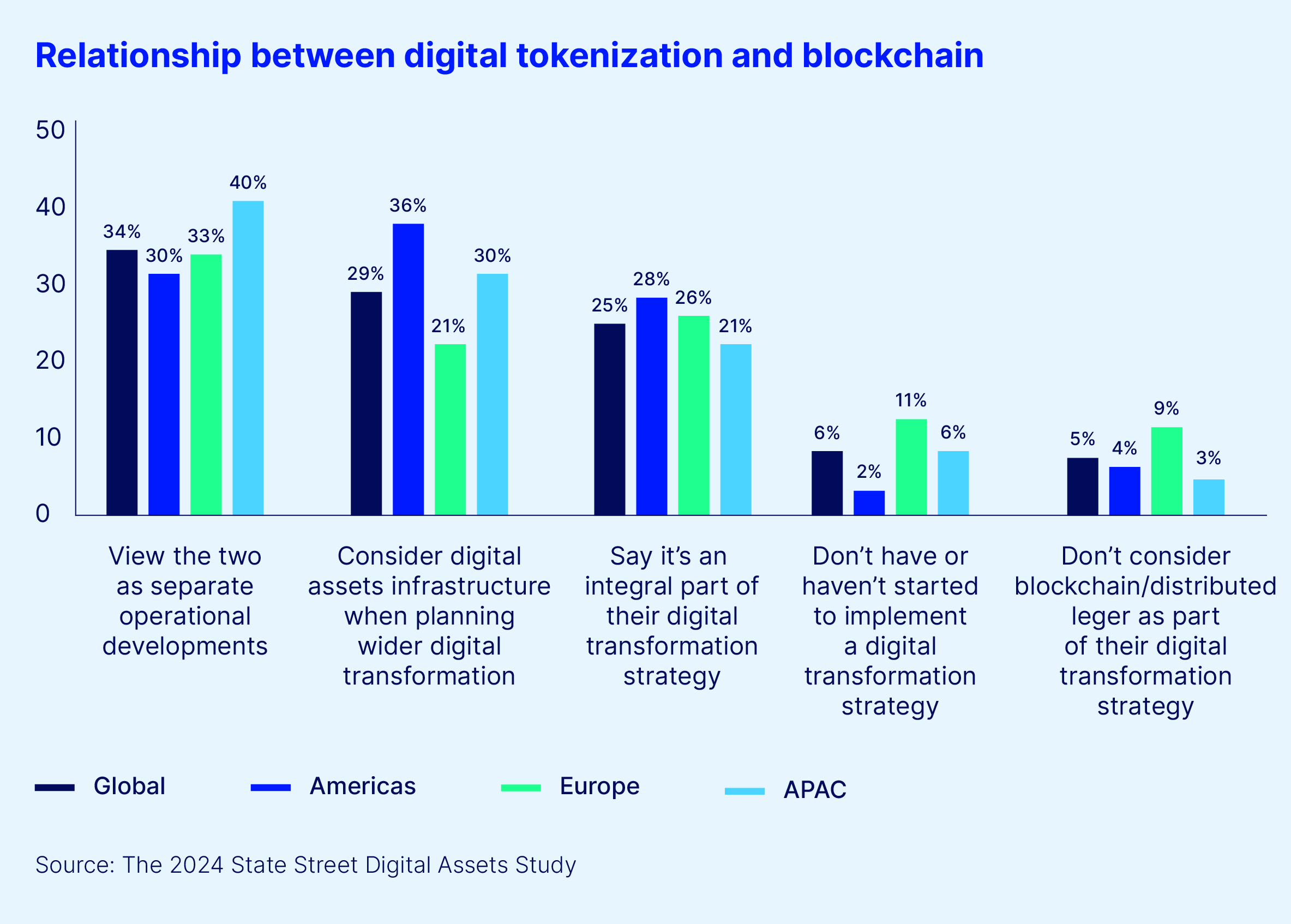

Although primarily dealing with digital assets and the infrastructure required to make them a part of the mainstream investment environment, our study also asked buy-side institutions about their broader digital transformation strategies.

We defined “digital transformation” as the “use of existing and advanced/emerging technologies to automate manual processes and remove manual/physical touchpoints and frictions from automated ones, in order to improve process efficiency and interoperability across core operations,” and asked respondents to explain the extent to which their blockchain strategies were part of a bigger strategy.

More than half (54 percent) answered that digital assets architecture is either a consideration within their wider digital transformation or an “integral” part of it, compared to just a third (34 percent) who indicated it was a separate consideration.

Unsurprisingly, generative AI was of particular interest to respondents, with perceived applications for a wide range of operations. When asked where generative AI would have the most impact within their organizations, nearly half cited front-office applications around securities selection and asset allocation, with a similar number pointing to risk management.

Interestingly, more than half (54 percent) also said it would complement and speed up digital assets developments by being able to “create blockchains, smart contracts and tokens, and provide other digital/tokenization services more cheaply, quickly and securely.”

How do the various “existing and advanced/emerging technologies” actually tie together across an investment institution’s operations? How does the network of different types of organizations that make the investment markets work to institute efficiencies and improve investor outcomes?

This article explores the sweeping changes, which these technologies introduce into capital markets, enhancing data security, optimizing decision-making processes and facilitating the creation of innovative financial instruments.

Blockchain: The future highway of modern financial transactions

Blockchain technology transcends the role of a secure transaction platform, with the potential to reshape financial markets through increased transparency, reducing fraud and lowering transaction costs. As a decentralized ledger, it enables the secure and efficient transfer of assets, streamlining transactions and improving reliability. The inherent traceability and immutability of blockchain can also support compliance with stringent regulatory requirements.

Digital assets: Expanding the horizons of investment

The emergence of digital assets – including cryptocurrencies and tokenized securities – is revolutionizing investment opportunities. Tokenization in particular allows us to bring traditional assets onto the digital highway, offering additional efficiency and accessibility. These assets, underpinned by blockchain technology, offer the promise of enhanced transparency, liquidity and accessibility, fostering a more inclusive and democratic financial ecosystem. As institutional investors increasingly seek exposure to alternative asset classes, digital assets present exciting opportunities for portfolio diversification and enhanced returns.

Generative AI: Pioneering advanced analytical capabilities

Generative AI is significantly impacting the financial services industry by enhancing data analysis, pattern recognition and predictive modeling. AI algorithms can now analyze vast data sets in real time, providing deeper insights into market trends, risk assessments and customer behavior. AI-driven tools and co-pilots are streamlining operations, improving customer service, enhancing investment decision-making, and unlocking new avenues of innovation and efficiency.

Quantum technologies: Accelerating computations and fortifying cybersecurity

The integration of quantum technologies will amplify the potential for transformation in the financial sector. Quantum algorithms and quantum-inspired optimization techniques will accelerate risk assessments, fraud detection and portfolio optimization, enabling financial institutions to mitigate risks more effectively, enhance customer protection and optimize asset allocation for better returns and stability. Furthermore, quantum technologies are poised to play a crucial role in fortifying cybersecurity, with advancements like quantum-resistant cryptography ensuring the confidentiality and integrity of sensitive financial information in an era of evolving cyber threats.

Synergies between AI, blockchain and quantum technologies

The convergence of AI, blockchain and quantum computing is anticipated to be transformative. Quantum technologies enhance AI’s data processing capabilities, while AI augments the operational efficiency of blockchain systems. This interplay ensures not only faster transactions, but also heightens the security and reliability of the data involved, reinforcing the robustness of financial market solutions.

Addressing challenges and ensuring a quantum-secure future

The integration of these sophisticated technologies does present challenges, including data privacy issues, regulatory compliance and substantial infrastructure investments. Developing a quantum-secure financial system is critical, necessitating evolved regulatory frameworks that can keep pace with rapid technological advancements. Strategic implementation approaches might include fostering collaborations between traditional financial institutions and fintech companies, advocating for supportive regulatory policies, and investing in skill development to equip professionals for the changing technological landscape.

Conclusion

The integration of digital assets, blockchain, generative AI – and in the future, quantum technologies – marks a significant evolution in the financial sector, promising to redefine its framework. By leveraging these technologies, financial markets can enhance operational efficiencies and drive significant economic growth and innovation. As the sector moves forward, the focus should be on harnessing these technologies to foster a more inclusive, efficient and secure financial ecosystem: the next frontier in capital markets.